FAQs - Frequently Asked Questions About Payday And Short Term Instalment Loans

Representative Example

Loan amount £200 repayable over 4 months. Total amount repayable £332.00 in 4 payments of £83.00. Interest 292% pa (fixed).

Representative 1307% APR.

Types of loan we offer

Short term payday style instalment loansRather than a traditional Payday Loan we offer a more flexible short term Instalment Payday loan which you can choose to repay over 4 or 6 months.

This is a rate capped product, which means that we cannot charge you more than 0.8% interest per day on the balance of your loan principal outstanding, we cannot charge you more than £15 in default fees and even if you do not repay on time you cannot be required to repay in total more than twice the amount you borrow. For example, if you borrow £150 you cannot be required to pay back more than £300 in capital, interest and charges.

You can apply for an Instalment Payday loan discreetly on this website, or you can discuss the application process by calling one of our friendly UK based advisers on 0113 887 3434 . Our advisers are fully trained and will be able to answer any questions you may have.

Please note that our Instalment Payday Loans are meant to help you meet your short term financial needs, they are not suitable for longer term borrowing, or if you are in financial difficulties. They would be very expensive as a means of borrowing over the longer term.

The Competition and Markets Authority payday lending market investigation concluded in 2015 with the publication of an Order requiring short term lenders to display specific information on their products from late May 2017 on one or more price comparison websites that are authorised and regulated by the Financial Conduct Authority. Part of the requirement is for us to show a hyperlink on the CASH4UNOW.CO.UK website to our chosen price comparison website provider.

A price comparison website, as its name suggests, allows the consumer to seek information about and compare the features and costs of a number of loans in order to assist in making an informed decision about which loan may be most suitable for them at that time.

CASH4UNOW.CO.UK is not required to display its products on more than one site, although some lenders may choose to do so. The comparison website on which our products are displayed may not compare all the products available in the marketplace. You can still find information about our loans here on the CASH4UNOW.CO.UK website.

To access the Choose Wisely site, click here

Risks and Benefits

Risks- There may be other, more suitable and/or cheaper forms of credit available to you that meet your needs at this time

- Although the product is price capped, the interest rate may still be considered 'high'

- Missed/late payments may attract a default fee

- Missed payments are reported to Credit Reference Agencies (CRAs) where these records may be seen by other lenders

- Missing payments (that are recorded at CRAs) may make it more difficult to get credit in future, or to rehabilitate your credit rating

- Other lenders may see evidence of high-cost short-term credit (HCSTC) on your credit record and this may influence applications for longer term credit e.g. a mortgage – all lenders have different criteria

- If your loan is in arrears, you may be charged default interest subject to the application of the rate cap for up to 60 days after your loan was scheduled to complete

- Becoming reliant on additional funding rather than taking steps to re-organise your finances

- Believing that a short term loan will help you out of financial difficulty – it will not

- No long term commitment, with repayment over 4 or 6 monthly instalments

- Used properly may help manage unexpected cash-flow situations

- Apply when it suits you with our convenient online application form

- We carry out thorough and detailed checks but can still give quick decisions

- Small sum credit, up to £250 for new customers

- Direct credit to your bank account

- Legal right to settle early in full or in part during term of loan

- Legal right of withdrawal

- Payment is taken from your debit card details supplied on application, you can cancel the ongoing authority (but if you do, you will need to provide an alternative form of payment to avoid going into arrears)

- Price-capped product, so you will never repay more than double what you originally borrowed, or more than £15 in default fees

- Customers with an established and secure repayment record may, subject to additional checks, be able to apply for up to £1,000

Applying for a loan

How does it work?Applying for one of our loans is easy. Fill out our secure online application form by clicking the Apply Now button. If you need assistance you can discuss the application process by calling one of our friendly UK based advisers on 0113 887 3434 .

Here's some more information

Adequate explanation

Before we can process your application, we have to provide you with important information known legally as an 'adequate explanation'. This will help you ensure that the credit agreement is suitable for your needs and financial situation. Please remember that a short-term instalment loan is unsuitable for longer term borrowing or if you are already in financial difficulty.

Pre-Contract Credit Information (PRECCI)

The PRECCI ensures that the borrower is aware of certain key information contained within the credit agreement, including:

- The amount of credit

- The cost of credit

- The number and amount of repayments and the total repayable

- Other information on the agreement such as key dates

- Costs in the case of missed payments

- Legal rights such as how to withdraw

- Information about the lender

The format of the PRECCI is determined by law and is common in all EU countries and the UK.

Fixed Sum Loan Agreement

Loans provided by CASH4UNOW.CO.UK are governed by a Fixed Sum Loan Agreement that is regulated by the Consumer Credit Act 1974. The agreement contains the following information:

- amount you are borrowing

- length of agreement

- amount and frequency of payments

- details of your cancellation rights (if applicable) and other forms of protection and remedies available

- the total charge for credit and the annual percentage rate of charge (APR)

We are a responsible short term lender and as well as using information from external agencies we also use information you provide to us such as on your application form and income/expenditure. We want our customers to be able to repay what they owe without negatively affecting their financial circumstances. We look at each request individually and will only make a loan if doing so allows us to meet our obligations as a responsible lender.

New customers can apply to borrow between £150 and £600. Customers who have borrowed with us before and have successfully repaid their loan or loans may be able to borrow amounts up to £1000 . We reserve the right to alter the maximum advances to both new and existing customers and will endeavour to show the latest information on our website.

We will not provide a short term Instalment Payday Loan if you have told us you are in financial difficulties or the credit assessment indicates that the loan may not be able to be repaid in a sustainable manner.

Table of Charges

The interest charge permitted on your loan is 0.8% per day of the outstanding loan principal. This means that, when you first drawdown your loan we will charge you no more than 0.8% per day on the amount borrowed until your first repayment becomes due. Thereafter, interest is charged on the remaining principal following each repayment. The total repayable is spread equally over 4 or 6 instalments to assist you with your monthly budgeting. Each repayment includes a principal amount calculated to repay the loan in the agreed number of instalments. The exact amount of interest will depend on your paydates.

Missed Repayment Charges

If you do not make payment on the payment date, we may charge you a default charge of £5 and this will be added to your account the day after the payment date. We may apply up to 3 default charges, if you miss 3 separate instalments (if applicable) totalling a maximum of £15 subject to the application of the rate cap.

We may also charge you default interest for the period you are in arrears at the flat contractual rate applying to the agreement and subject to the application of the rate cap.

If you do not pay us for an extended period of time, and do not contact us to let us know if you are experiencing financial difficulty, we may refer your account to an external debt collector.

To apply for one of our loans you will need to fulfil all these conditions:

- Are aged between 18 and 75

- Are resident in the UK

- Have a UK bank account with a valid debit card associated with it

- Receive your salary into the above bank account on a regular basis

- Have a steady income with a take home pay of at least £600 a month

- You must provide an email address

- You must provide at least one valid contact telephone number

- You must not be bankrupt, in an individual voluntary arrangement (IVA), debt management plan (DMP), debt relief order (DRO) or the Scottish equivalents (trust deed, sequestration)

We need to see evidence of a steady income of at least £600 a month being paid into the bank account you will use to repay your loan.

We won't make any direct contact with your employer without your permission. If we need to verify your income we might, with your consent, ask your bank to share income information with us.

Yes we will always carry out a credit check. Doing an applicant credit check is part of our commitment to being a responsible lender; it helps us to verify the information you provide to us on your application form.

If you have a variable or poor credit history it may affect our decision. We do not lend to applicants who are bankrupt or in an individual voluntary arrangement (sequestration or trust deed in Scotland).

We assess every application individually and we try to consider all circumstances fairly. You can help us to make a favourable decision by making sure the information on your application including details of your regular income and expenditure is truthful and accurate. However, we cannot guarantee to offer applicants a loan even if they have borrowed with us before.

CASH4UNOW.CO.UK does not lend to applicants in any of the above named debt solutions (or their Scottish equivalents) as part of our Responsible Lending assessments. Unfortunately, we cannot consider any application you choose to make if we see evidence of any of the above on your credit file or banking information, and so you may choose not to apply.

Our consumer credit agreement and application process require attestations that applicants are not in, nor thinking of going into, a debt solution such as bankruptcy or and IVA.

Not necessarily. Our loans are unsecured so we also consider a tenant's other circumstances, such as living with parents. There is space on the application form for you to tell us about this.

Yes, we will keep you updated throughout the application process by email. If we need to speak to you about the online agreement one of our advisers will contact you on the phone number you supplied to go through the information you have provided.

To meet our obligations as a responsible lender we may ask for additional information.

If we cannot contact you on the phone number you gave us there will be a delay in finalising your application until we can do so.

Our systems are designed to allow us to assess your application quickly and thoroughly without the need for you to send in additional documentation.

However we may occasionally need to verify some information. If we do you will be contacted by one of our advisors either by email or sms or on the telephone number you gave us.

Yes, certainly. Before we send you an agreement we are required by law to send you some pre-contract information.

Once you have been provisionally accepted you will receive, via email, what is called a 'Standard European Consumer Credit Information' document, referred to as a 'PRECCI' which contains the key details of your consumer credit agreement. The information contained in the PRECCI is set out by law, and you should read it carefully.

Together with the PRECCI document you will receive an 'Explanation about your loan' sheet. This too is required by law and gives you important information about short term lending in general and your loan in particular.

If you decide to go ahead you will receive a loan agreement to sign. You should read these documents carefully as they provide all the information you need to know about your loan. You should only sign the agreement if you are sure you wish to proceed and will have the money available to make the required repayments on time.

Once your loan is approved for payment, we will instruct our bank to send the money into your bank account.

We will pay the money into your bank account via Faster Payments. We aim to fund any successful application the same day (Monday to Friday only).

Before reapplying to us for a loan we suggest you wait until your financial circumstances have changed.

Please see our Frequently Asked Question- 'How can I improve my credit history'

Unfortunately we are not able to fund everyone who applies to us. If CASH4UNOW.CO.UK cannot offer you a loan and if you have given your express consent by ticking the box on the application form for us to pass on your details, including the application details you have already provided, we may pass your details to one of our carefully selected third party introducers including loan brokers who may be able to facilitate other loan options for you. We may receive a commission for this.

We carry out due diligence on our partners including introducers and loan brokers, to ensure they treat customers fairly and maintain minimum standards of compliance. This includes ensuring, as far as possible, that customers are not directed to other introducer or broker sites where up-front fees may be charged.

CASH4UNOW.CO.UK does not pass your details directly to other lenders. The introducer/broker who receives your details may work with a panel of lenders and you may receive multiple contacts by SMS, email, phone, post or by other method. Multiple credit searches may be carried out. CASH4UNOW.CO.UK has no influence over the lender panel with whom the introducer/broker works although we do seek reasonable confirmations from them as described above.

You should think carefully before providing your express consent for your details to be passed on. Other forms of credit may be available to you which may be cheaper, or more suited to your needs at this time.

We cannot improve your credit history but here are some tips which may help:

- Make sure you are registered on the electoral roll at your current address

- Try not to miss repayments on existing debts, including utility bills and mobile phone contracts

- Try to keep up with scheduled loan and other credit repayments, it is a positive point to show you are repaying what you have borrowed

- Always be truthful and accurate when making any application

- Get a copy of your credit file and check the information to make sure there are no mistakes

- When reviewing your credit file close down agreements you no longer use

- If you have a credit card with a limit you do not use, try to get the limit reduced

- Try not to have too many open credit commitments at the same time

- Try not to make too many applications for credit in a short space of time

- If you have a landline phone number as well as a mobile, include it on any application you may make

We welcome applications from customers who have successfully repaid a loan or loans with us and from time to time we offer additional benefits to returning customers . Although we can never guarantee further loans, when we assess any new application we may take into account your previous successful payment history and loan settlement(s) with us.

Responsible borrowers who have used our service before can apply for increased loan amounts over those we offer to new customers, although these are of course subject to our discretion and individual assessment.

We will only ever offer you a new loan if it is in line with our responsible lending commitments to do so.

You can re-apply online or by telephone by calling 0113 887 3434 and one of our agents will be able to initiate the new loan application for you (you will be required to finalise the details of the loan yourself as our agents cannot complete the process over the telephone).

Repaying a loan

How do I make repayments?For a short-term instalment loan we take each payment from your bank account on the agreed instalment date (as set out in your consumer credit agreement) by using the debit card details supplied during the application process. This is an automatic process and we set out how it works in the consumer credit agreement. We will attempt to contact you at least three days before each of your instalment payments under this process are due to remind you that your payment is due and to get in touch with us if you think you may have difficulty making the required repayment.

We also offer an online facility whereby you can make payment using our payment page at https://ems.ese.pm/cash4unow_WvC - you will need your six digit loan number and your postcode to use this facility.

In addition to the above we also have a 24 hour payment line which you can call on 0845 676 9676 and choose option one.

Please call 0113 887 3434 and speak to one of our advisers if you wish to repay your loan early.

You have a legal right to repay your loan early, in full or in part, before the contractual term of the loan has finished.

When you take a loan between 4 or 6 months with CASH4UNOW.CO.UK you have the flexibility to settle your loan early, either in full or in part, so you can pay off your loan before the agreement end date if you choose. This is a legal right. Repaying early may save you interest, as we charge interest on a daily basis on the oustanding principal. Please contact us on 0113 887 3434 for a personalised illustration.

Please call 0113 887 3434 and speak to one of our advisers if you wish to make a partial repayment of your loan.

You can make a partial repayment at any time to reduce the balance you owe.

You have a legal right to repay your loan early, in full or in part, before the contractual term of the loan has finished.

CASH4UNOW.CO.UK's customer service team keep an eye on how you are managing your account with us. If you miss your repayment they will make every effort to contact you to discuss the situation (via several different channels) starting with the day on which you should have made payment.

Our advisers are fully trained and understand that circumstances can sometimes change, so they will offer alternative solutions.

Please don't pretend things are alright if you can't pay, or ignore their calls or e-mails as this will only make the situation a lot worse.

If we haven’t received full payment on the due date we will apply a £5 missed payment fee. This will be added to your account the day after the payment date. We may apply up to 3 default charges of £5 if you miss 3 separate instalments (if applicable) totalling a maximum of £15 and subject to the application of the rate cap.

If repayment is by debit card, we will make one attempt to collect the amount of the due instalment (including any applicable charges) on the Payment Date, and one on the following day. We will never seek to recover part-payment unless you instruct us to do so. We will only make two attempts to collect payment where the attempts are not successful, therefore do not assume we will take the instalment automatically. We will only make a further attempt on your debit card with your express approval.

If your payment, on the continuous payment authority, is due within 5 working days and you think you may not be able to pay it is imperative you ring us rather than email us on 0113 887 3434 to let us know. We respond to most emails within 5 working days but if your payment is imminent and you cannot meet your obligation you must call one of our agents to ensure we can put a stop on your payment for you if this is the appropriate course of action.

If you don't respond to our attempts to contact you or we cannot agree a reasonable outcome we will pass your account to a FCA-authorised third party collections agency. This will be an external company who will contact you to obtain payment of your loan. We will always let you know if this happens, but we hope you will work with us to resolve the situation before this action becomes necessary.

It is extremely unlikely that CASH4UNOW.CO.UK will lend to you again. In addition, your outstanding debt would be notified to the Credit Reference Agencies, which may be seen by other lenders as part of their own application checks.

We appreciate that if you experience a sudden change in your financial circumstances you may not be able to meet the required scheduled payments. If you think you will have difficulty meeting the first scheduled repayment, please contact us at least 3 days before this repayment is due so we can help guide you through the options available. If the due date for your first monthly instalment has passed, please get in touch with us at the earliest opportunity if you feel you will not be able to make future repayments on time as they fall due so we can work with you to outline options available and agree a suitable repayment plan.

Your consumer credit agreement includes details of the process we use to collect repayments from you, and you should ensure that you understand this before you sign your agreement. Repayments will be collected from your bank account by a Continuous Payment Authority. You may cancel your Continuous Payment Authority by contacting either your bank or us.

If you decide to cancel, you must remember that you will still owe any outstanding debt and will need to provide an alternative method of repayment on the due date or thereafter, if the payment was not received, to avoid going into default or incurring additional interest and/or charges.

To cancel the authority directly with us, please get in touch.

Data Privacy

General Data Protection regulation (GDPR)On 25th May 2018 the biggest change in data privacy regulation in 20 years took effect in the UK. GDPR is needed to ensure that consumers receive enhanced protection in data privacy and reshape the way organisations approach data privacy, with the aim of protecting EU citizens from privacy and data breaches in an increasingly data driven world.

CASH4UNOW.CO.UK takes privacy of its applicants' and customers' data very seriously. We uphold the transparency provisions within GDPR and we have provided information to help you understand what data we collect from you, why we collect it, what we do with it and how we keep it secure.

Where we ask for your consent, we make this clear and ask you to take an affirmative action (eg ticking a box) to record your consent.

You can view our updated privacy policy here

General questions

Is a loan from CASH4UNOW.CO.UK suitable for my needs?We are a responsible short term lender. We want our customers to be able to repay what they owe without negatively affecting their financial circumstances. We look at each request individually and will only make a loan if doing so meets our obligations as a responsible lender.

However, it is a borrower's responsibility to decide if a loan is suitable for their needs.

Before applying, ask yourself 'Do I need to take out a loan?' and 'Can I use another source?'

Our documentation gives you the information you need to make an informed decision to apply for one of our short term payday instalment loans.

A 'payday' loan is designed to provide a cash advance with full repayment on your next payday, whereas, a short term instalment loan is designed to provide a cash advance that is repaid in equal amounts over your choice of four or six months.

Because there are cheaper forms of long term credit available, 'payday' or short term lending may not be suitable for attempting to sustain borrowing over longer periods.

Our loans should never be used if you are already in financial difficulties or possibly facing challenges keeping up with your existing commitments. For further help and advice click here for details of free debt counselling organisations who may be able to help you.

We provide loans with repayment options of four or six months. Application is a simple process which can be done via our website at CASH4UNOW.CO.UK. If you prefer to speak to someone please call us on 0113 887 3434 and one of our Agents will be able to help you complete your application.

A Payday Instalment Loan from us is not an answer to existing financial difficulties. Taking on additional credit when you are already having financial difficulties is not 'responsible borrowing' and will most likely add to your problems.

If you do feel you have existing financial problems, we suggest you seek help from one of the free advice agencies in the UK, such as the StepChange Debt Charity (www.stepchange.org/), or National Debtline (www.nationaldebtline.org).

We are a responsible lender. We want our customers to be able to repay what they owe without negatively affecting their financial circumstances. We look at each request individually and will only make a loan if doing so meets our obligations as a responsible lender.

Yes, we process new loans between 8am – 5:30pm Monday to Friday (Closed on Bank Holidays). Applications made on a bank holiday will be processed on the next working day.

The representative APR (APR stands for Annual Percentage Rate) is required by law to be included on certain documents and promotional material and is calculated according to a formula laid down by regulations.

Essentially the APR looks at annualized charges and the formula used (which is quite complex) means that really high APRs are often shown for very short term loans and they can give a distorted impression of what the interest charge applied to your loan really is.

Please see our rates and charges for detailed information about our interest rates.

We hope that you will be happy with every aspect of our service. If however you wish to make a complaint, please see our complaints policy.

Financial Difficulties

We understand that your circumstances may change, and you may be struggling to repay your loan payment. It is important if you’re experiencing financial difficulties that you let us know as soon as possible so that our friendly team can work with you to help. We have a range of options available to help.

If you haven’t missed your repayment yet, but you’re worried that you might, get in touch with us as early as possible and we will work with you to understand your circumstances and find a way to support you. Engaging early can help take a lot of the stress out of the situation.

If you’ve already missed a loan repayment, you may not be sure what to do, but doing nothing will only make it worse. Get in touch by replying to our email or WhatsApp or give us a call on 0113 887 3434.

Our promise to you

- We will never ask you to pay more than you can’t afford

- We will work with you to understand your situation

- We will help by offering a range of options for you to choose

- We will provide you tailored support, to meet your needs and take the stress out of the situation

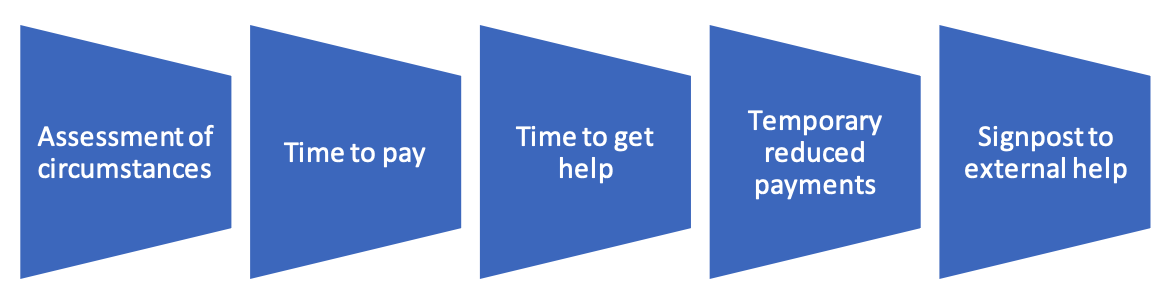

Options we can offer

Impacts of missing payments

Ignoring a debt problem may adversely impact your credit file, making it harder to obtain credit in the future. This is why early engagement is key. The longer a debt is left, the more damaging the record is likely to become.

If we accept lower repayments from you, we will tell you whether this is likely to impact your credit file as this may be considered as ‘falling behind with repayments’ and consequently passed to credit reference agencies

Credit Reference Agencies

You can check what information credit reference agencies have about you by contacting the following organisations:

- Equifax plc - www.equifax.co.uk/Products/credit/statutory-report

- Experian Limited - www.experian.co.uk/consumer/statutory-report.html

- TransUnion (formerly Callcredit plc) - www.transunion.co.uk/consumer/consumer-credit

When we contact you

Before your loan repayment is due, we will send you a friendly reminder of the payment due and date we will attempt to take the payment, as agreed as part of the agreement.

If you miss a scheduled payment, we will send you reminder emails, and sometimes WhatsApp or SMS text messages. You may also get phone calls asking you to bring the payments up to date.

We may pass your loan account to an authorised third-party collection company to contact you on our behalf, but we will not do this unless we have had no contact from you in response to our attempts.

You should not ignore these emails, messages, or calls from us. We’re contacting you to see how we can help. Ignoring the debt will only make the problem worse and is more likely to affect your credit file.

Formal notices

In certain situations, we are required by law to send you formal debt notices, these include:

- A Notice of Default Sums

- A Notice of Sums in Arrears

- A Notice of Default

A Notice of Default Sums

Where we charge a fee (for example a late payment fee), and it becomes payable, we must send you a notice of default sums (NoDS). This is not a default but relates to charges (default sums) which are added in connection with a breach of the agreement, but in addition to any accumulated interest. This notice will be emailed to you.

A Notice of Sums in Arrears

We are obliged to send this notice when you have missed at least two repayments and a sum is now due. This Notice of Sums in Arrears (NOSIA) will be emailed to you, and it will be accompanied by the FCA’s information sheet. The NOSIA does not itself affect your credit score, but the fact you have missed two payments will be recorded and is likely to impair your credit file. If your account remains in arrears, we will issue you with subsequent notice (SNOSIA) every 6-months until the account is up to date.

A Notice of Default

A default notice is a formal warning you that you are seriously behind on your repayments. The notice will be sent by postal letter and will include the FCA’s information sheet. It will provide you with at least 14 days to remedy the breach (by making payment). After which time, if the arrears have not been cleared, we will report the default to the credit reference agencies, and this will adversely impact your credit file.

Free and impartial debt advice

Money Helper provides consumers with free money guidance and debt advice.

www.moneyhelper.org.uk

0800 138 7777

National Debtline offer free and independent advice and fact sheets on bankruptcy, IVA, DROs etc.

www.nationaldebtline.org

0808 808 4000.

StepChange is a UK wide charity assisting consumers with free debt advice, budgeting, and solutions.

www.stepchange.org

0800 1381111.

Citizens Advice provide free, confidential advice to assist with debt and money worries, benefits, work, and legal problems.

www.citizensadvice.org.uk

03444 111 444.

Cash4Unow works directly with Payplan who offer free debt solutions including IVAs, Trust Deeds, free Debt Management Plans and help with bankruptcy.

www.payplan.com

0800 280 2816.

Christians Against Poverty is a charitable organisation offering consumers free help getting out of debt, budgeting, making their money go further, or help finding a job.

www.capuk.org

0800 328 0006.

Other Help Available

If there is something particular about your situation that impacts your ability to manage your loan – whether temporary or permanently such as physical/mental health conditions, a disability or personal circumstance, please get in touch. We have a team to support you and meet your needs. Where your situation requires more specialist support, we can put you in touch with charities and organisations who support you through the difficult circumstances.

National Bereavement Service - offer help with the practical side of bereavement informing people of the actions they need to take.

W: www.nationalbereavementservice.org

P: 0800 0246 121

Age UK - information and advice for the elderly on anything from health to housing.

W: www.ageuk.org.uk

P: 0800 169 2081

The Trussell Trust - for foodbanks, providing emergency food and support to people in crisis.

W: www.trusselltrust.org/map

P: 017220 580 171

E: foodbanknetwork@trusselltrust.org

Samaritans - for anyone who needs to talk to somebody anytime they like, in their own way, and off the record - about whatever is getting to them. They don't have to be suicidal.

W: www.samaritans.org

P: 116 123

E: jo@samaritans.org

Macmillan - practical, medical and financial anyone affected by cancer and someone who'll listen you just want to talk.

W: www.macmillan.org.uk

P: 0808 808 0000

Mind - advice and support for anyone suffering from mental health issues (e.g depression, anxiety, bi-polar, suicide ideation, schizophrenia, psychosis).

W: www.mind.org.uk

P: 0300 123 3393

T: Send a text to 86463

Carers UK - advice, information and support for anyone looking after someone in a caring capacity.

W: www.carersuk.org

P: 0808 808 7777

Alzheimer's Society - advice, support and information about dementia.

W: www.alzheimers.org.uk

P: 0300 222 1122

Victim Support - help people affected by crime or traumatic events get the support that they need.

W: www.alzheimers.org.uk

P: 0808 1689 111